Online trading has become an essential component of the global economy in today’s complex environment. For the uninformed, online trading may appear to be a difficult, enigmatic undertaking, but the fact is that anybody with an internet connection and a willingness to trade may participate. This essay will uncover the complexities of online trading, giving you a more than basic grasp of the mechanics, techniques, and rewards it provides. This excursion into the world of internet trading will help you on your trip, whether you’re a newbie eager to test the waters of the financial markets or an experienced trader seeking deeper insights.

The way people invest and handle their money has been completely transformed by online trading. The frenzied phone calls and noisy trading floors of yesteryear are long gone. Investors may purchase and sell a variety of financial assets from the comfort of their homes with only a few clicks or taps. As a result of the abundance of opportunities and difficulties brought on by this accessibility, future traders must comprehend the fundamental ideas and mechanisms behind this digital financial environment.

This article will go over the basics of internet trading, the major companies, the many assets you may trade, and how market research can help you make wise choices. We’ll also talk about how important risk management is and various trading tactics that might help you succeed. So, buckle in and let’s go on a journey to learn about the benefits of online trading so that you can have the knowledge and confidence to successfully navigate the financial markets.

Choosing a Trading Platform

You must decide on a trading platform or brokerage before starting any online trading. One possible option is a new trading platform named Quantum AI. You can conduct transactions in the financial markets thanks to platforms like these, which serve as mediators. They take several shapes, ranging from conventional brokerage companies to platforms that exclusively operate online. Your platform selection should reflect your interests, risk tolerance, and investing goals.

What to consider?

- Security

To secure your personal and financial information, look for platforms with strong security features.

- Fees

Recognising the cost structure is crucial since different trading platforms have different fees for trades.

- Asset Choice

No matter if you’re interested in stocks, bonds, cryptocurrencies, or FX, be sure the platform gives you access to the asset classes you want.

- Friendly User Interface

Your trading experience may be streamlined with the use of a user-friendly platform and an intuitive interface.

Account Creation

After you’ve decided on a platform, you’ll need to open a trading account. Typically, this procedure includes submitting personal information, validating your identification, and depositing dollars into your account. During this phase, it is critical to follow all regulatory obligations.

Market Analysis

Thorough market research and analysis are required for successful online trading. This is how it works:

- Asset Choosing

You will select the financial instruments that you wish to trade. Stocks, commodities, currencies, and derivatives such as options and futures are examples of these.

- Examination

To make educated judgements, traders use analytical approaches such as technical analysis (viewing price charts) and fundamental analysis (assessing a company’s financial condition).

- Risk Evaluation

It’s critical to evaluate the degree of risk connected with each trade and decide how much cash you’re ready to put in danger.

Execution of Trades

After conducting your research and deciding on a deal, you may execute it using your preferred trading platform. This entails defining the asset, the quantity you wish to trade, and whether you intend to purchase (go long) or sell (go short).

Monitor and manage positions

The process of online trading does not finish with the execution of a deal. You must constantly monitor and manage risk in your jobs. Setting stop-loss orders to prevent possible losses, modifying your bets as market circumstances change, and determining when to leave a position to ensure gains are all part of it.

What are the assets available to you?

Stocks

Stocks signify ownership in a corporation. You become a shareholder of a company when you purchase shares of its stock, and your financial success is based on how well the firm performs.

Bonds

Bonds are debt securities that have been issued by businesses, governments, or other organisations. When you buy a bond, you’re effectively giving the issuer money and will get interest payments every so often until the bond expires.

Commodities

Physical things like gold, oil, and agricultural products are examples of commodities. Trading in commodities entails making bets about how their prices will develop in the future.

Foreign Exchange, or Forex

One currency is traded for another on the forex market. Since it is the world’s biggest and most liquid financial market, currency traders choose it.

Cryptocurrencies

As tradable assets, cryptocurrencies such as Bitcoin and Ethereum have grown in popularity. They use blockchain technology and provide distinct opportunities and hazards.

What are the trading strategies?

- Day Trader

Day traders purchase and sell assets during the same trading day to capitalise on swift price changes. This tactic necessitates ongoing market observation.

- Swing Investing

Swing traders try to profit from price changes that last a few days to a few weeks. Compared to day traders, they could keep positions open for longer.

- Long-Term investments

The goal of long-term investing is to purchase assets to own them for many years or perhaps decades. The long-term growth of the asset is what they hope to profit from.

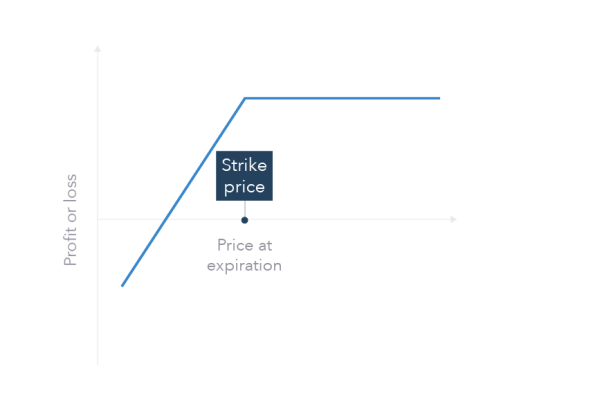

- Derivatives and Options Trading

Options and derivatives enable traders to make predictions about how the prices of underlying assets will change in the future. These can be applied to hedging or implementing more sophisticated techniques.

Tips for Successful Online Trading

- Education

Continue to learn new things. Maintain your knowledge of the markets and trading techniques.

- Emotional Regulation

Avoid making hasty judgements motivated by greed or fear.

- Risk Management

Put protecting your cash first by using risk management.

- Trading Scheme

Create a strategy for your trade and follow it.

- Continuous Evaluation

Examine your performance and change your tactics as necessary.

Online trading has transformed how people and organisations interact with financial markets. While it provides huge potential, it also brings significant hazards. You may start your online trading career with confidence if you grasp the mechanics, players, assets, tactics, and risk management concepts. Remember that online trading success is typically the result of a mix of education, dedication, and experience. So, to effectively traverse the world of internet trading, be knowledgeable, watchful, and make informed selections.